Accounting System

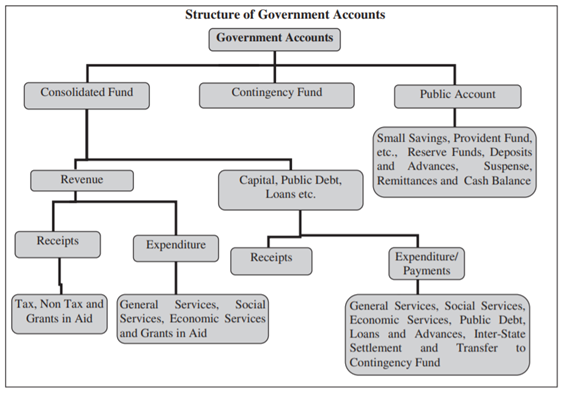

1. The accounts of Government are kept in the following three parts:

- Part I - Consolidated Fund

- Part II - Contingency Fund

- Part III - Public Account

In Part I, namely Consolidated Fund, there are two main divisions, Viz.:

- Revenue: consisting of sections for 'Receipt heads (Revenue Account)' and 'Expenditure heads (Revenue Account)'

- Capital, Public Debt, Loans, etc.: consisting of sections for 'Receipt heads (Capital Accounts)', 'Expenditure heads (Capital Accounts)' and 'Public Debt, Loans and Advances, etc'.

The Revenue division deals with the proceeds of taxation and other receipts classified as revenue and the expenditure met there from, the net result of which represents the revenue surplus or deficit for the year.

In Capital division 'Receipt Heads' (Capital Account)' deals with receipts of capital nature which cannot be applied as set-off to capital expenditure.

The section 'Expenditure Heads (Capital Account)' deals with expenditure met usually from borrowed funds with the object of increasing concrete assets of a material and permanent character. It also includes receipts of a capital nature intended to be applied as a set-off against expenditure.

The Section 'Public Debt, Loans and Advances, etc.' comprises loans raised and repayments by Government such as 'Internal Debt' and 'Loans and Advances' made (and their recoveries) by Government. This section also includes certain special types of heads for transactions relating to 'Appropriation to the Contingency Fund' and 'Inter-State Settlement'.

In Part II, namely Contingency Fund, of the accounts, the transactions connected with Contingency Fund established under Article 267 of the Constitution of India are recorded.

In Part III, namely Public Account, of the accounts, the transactions relating to 'Debt' (other than those included in Part I), 'Deposits', 'Advances', 'Remittances' and 'Suspense' are recorded. The transactions under 'Debt', 'Deposits' and 'Advances', in this part are those in respect of which Government incurs a liability to repay the moneys received or has a claim to recover the amounts paid, together with the repayments of the former ('Debt', and 'Deposits') and the recoveries of the latter ('Advances'). The transactions relating to 'Remittances' and 'Suspense' in this part embrace merely adjusting heads under which appear such transactions as remittances of cash between Treasuries and currency chests, transfers between different accounting circles, etc. The initial debits or credits to these heads will be cleared eventually by corresponding receipts or payments either within the same circle of account or in another account circle.

Sector and Heads of Accounts : Within each of the sections in Part I mentioned above, the transactions are grouped into sectors such as 'Tax Revenue', 'Non-Tax Revenue' and 'Grants-in-aid and Contributions' for the receipt heads (Revenue Account), and 'General Services', 'Social Services', 'Economic Services' and 'Grants-in-aid and contributions' for expenditure heads. Specific functions or services (such as Education, Sports, Art and Culture, Health and Family Welfare, Water Supply, Sanitation, Housing and Urban Development, etc. in respect of Social Services) are grouped in sectors for expenditure heads. In Part III (Public Account) also, the transactions are grouped into sectors, such as 'Small Savings', 'Provident Funds', 'Reserve Funds', etc. The Sectors are sub-divided into major heads of account. In some cases, the sectors are, in addition, sub-divided into sub-sectors before their division into major heads of account.

The Major heads are divided into Sub-Major heads in some cases and Minor heads, with a number of subordinate heads, generally known as Sub-heads. The Sub-heads are further divided into Detailed heads. Under each of these heads, the expenditure is shown distributed between charged and voted. Some times Major heads are also divided into Sub-Major heads before further divisions into Minor heads. Apart from the Sectoral and Sub-sectoral classification the Major Heads, Sub-Major Heads, Minor Heads, Sub-Heads, Detailed Heads and Object-Heads together constitute a six-tier arrangement of the classification structure of the Government Accounts. The Major, Minor and Sub-heads prescribed for the classification of expenditure in the general accounts are not necessarily identical with the Grants, Sub-heads and other units of allotments which are adopted by the Governments for Demands for Grants presented to the Parliament or Legislatures but in general a certain degree of correlation is maintained between the Demands for Grants and the Finance Accounts.

The Major heads of accounts, falling within the sectors for expenditure heads, generally correspond to functions of Government, while the Minor heads, subordinate to them identify the programmes undertaken to achieve the objectives of the function represented by the Major head. The Sub-head represents the scheme, the Detailed head, the sub-scheme and object head,theobject level of classification.

2. Coding pattern

Major Heads: From 1st April 1987 a four digit code has been allotted to the Major heads, the first digit indicating whether the Major head is a Receipt head or Revenue Expenditure head or Capital Expenditure head or a Loan head.

The first digit of code for Revenue Receipt head is either '0' or '1' . Adding 2 to the first digit code of the Revenue Receipt head gives the number allotted to corresponding Revenue Expenditure head; adding another 2, the Capital Expenditure head; and another 2, the Loan head of Account. For example, for Crop Husbandry code 0401 represents the Receipt head, 2401 the revenue expenditure head, 4401 the Capital Outlay head and 6401 the Loan head.

Such pattern is, however, not relevant for those departments which are not operating Capital / Loan heads of account e.g. Department of Supply. In a few cases, where receipt and expenditure are not heavy, certain functions have been combined under a single Major head,the functions themselves forming Sub-Major heads under that Major head.

Sub - Major heads: A two digit code has been allotted, the code starting from 01 under each Major head. Where no Sub-Major head exists it is allotted a code "00". The nomenclature 'General' has been allotted as Code "80" so that even after further Sub-Major heads are introduced the code for 'General' could continue to remain the last one.

Minor Heads: These have been allotted a three digit code, the codes starting from '001' under each Sub-Major/Major head (where there is no Sub-Major head). Codes from '001' to '100' and few codes '750' to '900' have been kept reserved for certain standard Minor heads. The coding pattern for Minor heads has been designed in such a way that in respect of certain Minor heads having a common nomenclature under many Major / Sub-Major heads, the same three digit code is adopted as far as possible.

Under this scheme of codification, the receipt major heads (Revenue Account) are assigned the block numbers from 0020 to 1606, expenditure Major heads (Revenue Account) from 2011 to 3606, expenditure Major heads (Capital Account) from 4046 to 5475, Major heads under 'Public Debt', from 6001 to 6004 and those under 'Loans and Advances', 'Inter-State Settlement' and 'Transfer to Contingency Funds' from 6075 to 7999. The code number 4000 has been assigned for Capital Receipt Major head. The only Major head 'Contingency Fund' in Part II 'Contingency Fund' has been assigned the code number 8000.

The Major heads in the Public Account are assigned the code number from 8001 to 8999.